According to reports from the Global Times and related sources, starting June 20, 2025, the EU imposed restrictions on Chinese medical devices from participating in its public procurement for contracts exceeding €5 million. In response, on July 6, China’s Ministry of Finance announced reciprocal measures, excluding EU enterprises (excluding EU-funded companies operating in China) from participating in Chinese government medical device procurements over RMB 45 million, and limiting the share of imported products from non-EU companies in the EU to no more than 50%. These policies have direct implications for tungsten alloy enterprises, particularly those involved in radiation shielding and radioactive medical equipment.

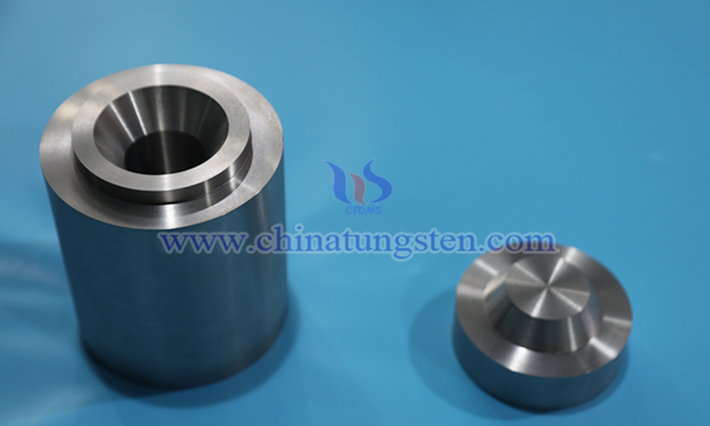

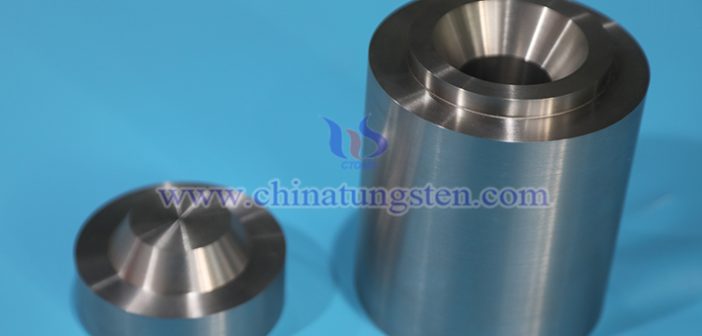

Tungsten alloys, especially high-density tungsten alloys (typically W-Ni-Fe or W-Ni-Cu systems), are widely used in the medical field due to their high density (approximately 17–19 g/cm3 ±0.1 g/cm3), excellent hardness (HV 320–400 ±10), wear resistance (wear rate <0.05 mm3/N·m ±0.01 mm3/N·m), and high-temperature stability (tolerating temperatures >1000°C ±50°C). These alloys are critical in radiation protection and radioactive medical applications, such as X-ray and gamma-ray shielding components, radiotherapy equipment parts (e.g., linear accelerator collimators), and nuclear medicine imaging devices (e.g., PET/CT shielding assemblies). Their superior gamma-ray attenuation coefficient (>0.6 cm2/g ±0.05 cm2/g) and biocompatibility (conforming to ISO 10993) make them indispensable in the radiation-based medical field. As China’s medical equipment industry becomes more self-reliant, tungsten alloys are playing a key role in the localization process.

Impact Analysis on China’s Tungsten Alloy Enterprises

- Limited Export Market with Controllable Impact

The EU is the world’s second-largest medical device market, with a market size of around €200 billion in 2024. Chinese high-density tungsten alloy medical products (such as radiation shielding components) previously accounted for approximately 5%–10% of EU imports. Based on 2024 data from the China Chamber of Commerce for Import and Export of Medicines and Health Products, China’s total medical exports reached $35.8 billion, of which the EU comprised about 15% (roughly $5.4 billion). The EU’s new restrictions may reduce tungsten alloy exports by 10%–20% (equivalent to $540 million–$1.08 billion), affecting mainly export-oriented companies in Zhejiang and Jiangsu. However, China accounted for over 80% of global tungsten production in 2024 (about 96,000 tons ±5,000 tons), with a self-sufficiency rate exceeding 90%, and only 20%–25% of total output being exported. Therefore, any restricted volume can largely be absorbed by the domestic market or redirected to other markets (e.g., Southeast Asia, India), keeping the overall impact manageable. - Major Opportunities in Domestic Substitution

China’s countermeasures do not affect EU-funded enterprises operating within China (such as Siemens and Philips’ Chinese factories), creating a market gap that domestic tungsten alloy producers can fill. Reports indicate that domestically produced high-end radioactive medical equipment (such as United Imaging’s PET/CT systems) now accounts for 30%–50% of government procurement. As key components in radiation protection (e.g., shields and collimators), high-density tungsten alloys are witnessing surging demand. In 2024, domestic substitution rates reached 60%–80% for equipment under RMB 5 million and 30%–50% for equipment over RMB 10 million. Over the next 2–3 years, these rates are expected to rise to 70%–90%. For instance, demand for tungsten alloy shielding components in PET/CT devices is growing at 15%–20% annually. Leading manufacturers such as Xiamen Tungsten have seen capacity utilization rates increase from 70% in 2023 to over 85% in 2025. This trend highlights how domestic substitution is significantly driving demand for tungsten alloys, especially in radiotherapy and nuclear imaging. - Supply Chain Adjustment Encourages Self-Reliance

The EU restrictions are accelerating China’s move away from reliance on EU-sourced raw materials. China holds about 60% of global tungsten reserves (approx. 1.9 million tons) and has a self-sufficiency rate exceeding 90%. While high-end processing technology has historically depended on Europe, Chinese enterprises are making rapid advancements. By 2025, domestic tungsten powder production capacity is expected to increase by 10%–15%, and some companies have developed independent smelting technologies (e.g., powder injection molding), cutting costs by 5%–10%. Although short-term fluctuations in raw material prices are possible (e.g., tungsten powder prices may rise 5%–10%), localized supply chains will enhance resilience in the long run, benefiting high-density tungsten alloy manufacturers. - Technological Innovation Driving Industry Upgrading

The EU’s protectionist stance is catalyzing technological independence in China’s tungsten alloy sector. Emerging applications of AI and advanced polymers present new opportunities. Tungsten alloy manufacturers can integrate AI-driven techniques such as 3D printing for radiation shielding components, reducing production costs by 10%–20%. According to CCID Consulting’s 2024 forecast, China’s high-end medical device market is projected to reach RMB 2.27 trillion during the 15th Five-Year Plan period. Demand for high-density tungsten alloys may grow 30%–40%, particularly in radiotherapy equipment (e.g., linear accelerators) and nuclear imaging (e.g., SPECT). With increased investment in R&D, Chinese companies can transition from low-end contract manufacturing to high-end radiation-resistant materials, capturing more market share. - Trade Environment Challenges and Long-Term Benefits

Tensions in China-EU trade are mounting. EU investigations revealed that China's "Buy China" policies led to a drop in imported medical device approvals from 132 in 2019 to just 46 in 2021. Similar retaliatory restrictions could further impact tungsten alloy exports. However, Chinese enterprises can mitigate risks by leveraging domestic policy support (e.g., prioritized procurement) and international partnerships. For example, China may benefit from its collaboration with South Korea’s Almonty Industries, whose Sangdong mine is expected to supply 50% of its capacity to China in 2025. The upcoming China-EU summit in late July could facilitate dialogue and reduce trade tensions, but the long-term trend of domestic substitution will continue to favor Chinese firms.

Conclusion

Although the EU’s restrictions may temporarily limit exports for high-density tungsten alloy enterprises, the overall impact remains manageable. Meanwhile, rising domestic demand and a strong substitution trend are set to significantly drive growth in the tungsten alloy industry. Over the next 2–3 years, Chinese tungsten alloy enterprises are expected to benefit from favorable government procurement policies, technological advancements, and localized supply chains—transforming their strategy from reactive to proactive. This shift will enhance their competitiveness in radiation shielding and radioactive medical applications, especially against the backdrop of rapid expansion in China’s high-end medical device industry.

![[Know Molybdenum] Key Applications of Molybdenum-Copper Sheet in Electronic Packaging Mo60Cu40 Molybdenum-Copper Sheet](http://www.zithromax.com.cn/en/wp-content/uploads/2025/07/molybdenum-copper-sheet-en-214x140.jpg)

![[Know Molybdenum] What Are the Applications of 0.2mm Molybdenum Sheet? 0.2mm Molybdenum Sheet](http://www.zithromax.com.cn/en/wp-content/uploads/2025/07/0.2mm-molybdenum-sheet-en-214x140.jpg)

![[Know Tungsten] The Performance of U-shaped EB Tungsten Filament U-shaped EB tungsten filament](http://www.zithromax.com.cn/en/wp-content/uploads/2025/07/U-shaped-EB-tungsten-filament-en-214x140.jpg)